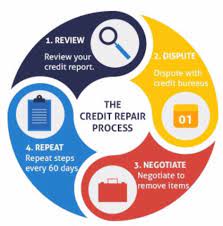

process of credit repair

Credit repair companies can help you dispute errors on your credit report. They may also help you establish new lines of credit. However, you should be aware that credit repair is a lengthy process and it can take up to a year for your credit score to improve. Moreover, it’s important to choose the right company. Make sure you read reviews and compare prices before making a decision. Also, check whether the company follows federal laws.

Miami is a popular destination for tourists and business professionals. But living in The Magic City can be costly. High mortgage and auto loan interest rates can drain your income. Fortunately, improving your credit score can lower these rates and save you thousands of dollars over the life of your loans.

A good Credit Repair Miami company will start the process by requesting your current credit reports from Equifax, Experian and TransUnion. They will review your report for any derogatory marks such as late payments, collections, tax liens, repossessions and bankruptcy. Once they find an error, they will notify the credit bureaus and begin the investigation process. They will send you periodic updates of the status of each disputed item.

Can you explain the process of credit repair and how it works in Miami?

If the credit repair company can’t get the negative information removed from your report, they will notify you in writing. The credit repair company must also give you a copy of your legal rights under the Credit Repair Organizations Act (CROA). You can use this information to protect yourself from scams. Also, stay away from companies that demand payment upfront or promise unrealistic results. For example, a credit repair company can’t guarantee that they can remove accurate information from your report or advise you to create a new identity.

You can also contact the federal Consumer Financial Protection Bureau for more information about how to recognize credit repair scams. If you have been a victim of a credit repair scam, don’t be embarrassed to report it. You can also file a complaint with the CFPB or Department of Banking.

Miami-based Lineup Credit Repair helps consumers increase their credit ratings by disputing inaccurate information on their credit reports. Its case advisers work with clients to develop customized credit improvement programs and educate them on how to maintain a positive credit rating. In addition, it is affiliated with FCRA attorneys to defend the rights of consumers against credit bureaus that violate the law. Its services are available to both English and Spanish-speaking customers.